Wyoming’s minerals provide the state with severance tax revenue, which is used to help run the government, build schools and highways, maintain the state’s water systems, and provide revenue for future generations.

Severance Tax Benefits

In 1969, Wyoming created the first severance tax on minerals under the condition that 2% of all severance taxes be placed in the new Permanent Mineral Trust Fund.

These taxes were proposed for a variety of reasons, particularly to provide for the state when minerals are not profitable to extract, and raise the state’s revenues without raising taxes on its citizens.

These taxes insure that costs associated with oil, gas and mineral extraction—road construction, maintenance, and environmental protection—are paid by the producers instead of putting the burden on taxpayers.

Most of the taxes collected go into a general fund that helps fund schools, roads and water systems, and balance the state budget.

Coal’s Economic Impact (2013)

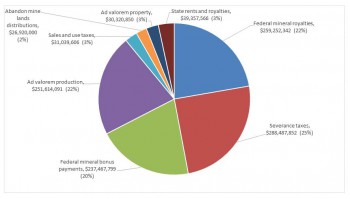

Coal is an important source of income for Wyoming, and is the second largest source of tax revenue for state and local government. Coal mining companies pay tax and royalty payments to all branches of government, federal, state, and local. In Wyoming, coal contributes over $1 billion annually in revenue to state and local governments.

Federal Royalties, $259.3 million

These royalties help pay for schools and expand the Budget Reserve Account.

Severance Tax, $288.5 million

Coal contributes to the overall Permanent Wyoming Mineral Trust Fund, which provides for the state when minerals are not profitable to extract, and the taxes became a smaller portion of government revenue.

Abandoned Mine Land (AML) Distributions: $26.9 million

These grants are used for mine site reclamation projects on lands and water mined, or affected by, coal mining processes.

Ad Valorem Tax on Production, $251.6 million

Ad Valorem Tax on Property: $30.3 million

Ad Valorem taxes are a tax on the property value of the mineral leases.

Federal Mineral Bonus Payments: $237.5 million

Funds from federal mineral bonus payments build Wyoming schools. In the past 15 years, money from coal bonus bids has built new schools in every county in Wyoming.

Sales and Use Tax: $31 million

State Royalties and Rents: $39.4 million

It’s easy to see that Wyoming coal mining is a very big part of the tax money that supports Wyoming and the entire nation. Without coal mining, Wyoming schools could not offer the superior education that Wyoming children receive today.

Coal Mining Jobs

Wyoming’s 19 coal mines employed a total of 6,500 workers in 2014, a 54% increase over the past 10 years.

Coal industry jobs are among the best paying in the state. Wyoming coal miners take home an average of $82,000 before benefits—almost twice the statewide average. Estimates indicate that each coal industry position drives the need for three additional jobs in the state.